An investment calculator enables you to determine if you are making a gain or a loss from your investment, and usually the calculation is done in percentage.

To work out these, you will need your initial purchase price, or simply your original amount for the investment, and the selling price of the investment.

Since your intention for investment is to generate income for future use, you may consider monetary asset purchases. These may include treasury bills, bonds, mutual funds, stocks, real estate, etc.

Your aim as an investor is to make profits; hence, your investment gain will largely depend on the selling price and your initial purchasing price.

Understanding a Gain or Loss In An Investment Calculator

Also known as capital gain or loss, these are the changes that result from selling a monetary asset or from making an investment.

Calculating a gain or loss on your investment on a regular basis therefore not only allows you to make necessary adjustments for a profit but also allows you to determine your investment overall value at the end of the working year.

If you get an increase from the previous year, then you are in for profits.

The percentage gain or loss for your investment will therefore be calculated by subtracting the initial purchase price from the selling price .

The figure you arrive at is then divided by the initial purchase price and multiplied by 100.

You will have a gain on your investment if the percentage turns out to be positive, implying the market value (selling price) is much more than your initial purchase price.

The opposite is true when you get a negative percentage.

As an investor, it’s necessary that you understand the percentage gain or loss so as to be aware of the significance of price movement and return on investment.

This then allows you to make a decision based on the historical performance of the type of investment you choose and whether there is a need for adjustments in case the investment is performing poorly.

Take charge of your investment calculator!

In Kenya, the Capital Markets Authority advises that;

- You stay on course with your investment by making regular reviews and monitoring to ensure that the investments are relevant to your financial goals.

- Monitor prices, attend annual general meetings, etc.

- Track your investment performance to help you determine if your expectations for returns have been met. Or if you can restructure the investments in case your assets get out of balance.

“People who invest make money for themselves; people who speculate make money for their brokers.”-Benjamin Graham

The Bible on Investment

Ecclesiastes 11/2;

Give portions to seven, yes to eight,

For you do not know what disaster may come upon the land.

Not all that we put into investment goes as per our expectations.

There will be setbacks even if you put the necessary precautions in place.

We are therefore required to spread or diversify our investments across various investment products. This is to ensure that when one investment goes down, we can always cling to the other one to stay afloat.

In this article, we shall be looking at ways of determining a percentage gain or loss on an investment using investment calculator formulas.

How to Calculate a Percentage Gain or Loss Using an Investment Calculator Formula When Selling Your Stock

Let’s use this example as our baseline in the course of this discussion.

John at a stock market bought shares at Ksh 50,000 and sold his shares after 6 months at Ksh 60,000 when the selling prices were high, making a profit of Ksh 10,000.While his friend Jane bought the same stock much later for Ksh 40,000 and sold it later for Ksh 50,000, making a profit of Ksh 10,000.

The profit may seem to be the same for both investors, but the gains they made individually from selling their stock are different.

John paid a higher amount to purchase stock, but he gained less compared to Jane, who bought the same stock at a much lower price and sold it for the same profit, gained more than John.

With less money, she was much less at risk and could even diversify her investments by buying other shares in another company using the Ksh 10,000 she saved from the initial purchase price.

The Percentage gain/loss formula;

Investment percentage gain/loss = selling price –initial purchase price × 100

Initial purchase price

The above calculation will produce an amount equivalent to the gain or loss in the numerator.

That amount is then divided by the initial purchase price to get a decimal that will show how much was gained compared to your original investment. To get a percentage gain, you are therefore required to multiply by 100.

It’s also important to note that you can still determine your percentage gain or loss even without selling your investment.

You can simply do this by substituting the current market price for the selling price. These will give you an unrealized percentage gain or loss since selling has not taken place.

What You Need To Know About Investment Calculator;

To get your percentage gain or loss calculation, you need to…

- Determine your initial purchase price

- Know the selling price,

- subtract your initial purchase price from selling price,

- factor in commissions and your dividends,

- turn your gain or loss into percentage

Let’s have a workable example:

We can still use the example of John above, who received Ksh 100 as a dividend on his investment and paid a commission of 10% in taxes.

Firstly,

You will get your investment gain as follows,

Gain=selling price-purchase price

Selling price: Ksh 60,000

Initial purchase price: Ksh 50,000

Johns investment gain = Ksh 60000–50000.

Gain =Ksh 10,000

Now factoring in taxes and dividends;

Total Investment gain =10000+100

Commission paid in taxes=total investment earnings × tax rate in decimal

=10100 × 0.1

=1010

Net gain=investment earnings-tax paid

=10100-1010

=9090

So to get a percentage gain;

Percentage gain = Net gain/ Initial purchasing price × 100

= (9090/50000) × 100

=18.18%

Percentage Gain for John’s Investment Without Factoring In Taxes and Dividend.

Percentage gain = selling price –initial purchase price × 100

Initial purchase price

=60000-50000 × 100

50000

= (10000/50000) ×100

= 0.02×100

=20%

The percentage gain for investment for john is therefore 20%.these will enable john to make a decision basing on the performance of the investment in this case the stock market.

Now if john would have sold his shares at 40,000 may be due to risk associated with stocks, he would have made a loss as shown from the working below.

Loss =40000-50000

=-10000

% loss = (-10000/50000) ×100

=-20%

His percentage loss will therefore would have been -20%.

From the above calculations we can clearly see that for a more accurate percentage gain or loss representation, you have to factor in commission paid in taxes and income from dividends earned on the investment.

How To Calculate Percentage Gain or Loss Using Investment Calculator Formula In Excel

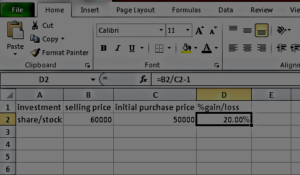

Still using John’s data above;

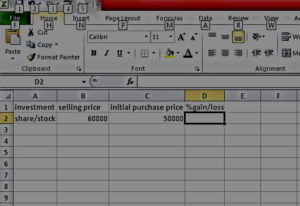

Firstly we enter the data in the excel sheet as shown below

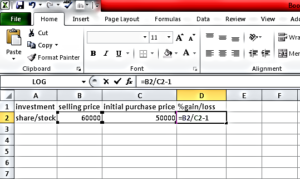

For definition purposes, we can let S be the selling price and P be initial purchase price such that the formula is S/P-1

But Because our interest is in the value we shall highlight where we want our value to appear, in these case cell D then we shall insert the formula, as =B2/C2-1 which will be enter in cell D2 as shown below .

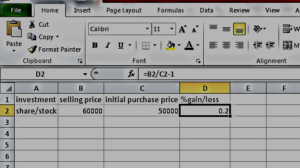

Press enter to get 0.2

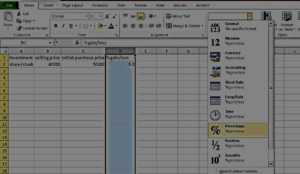

For you to get to get your value in Percentage,

Highlight the column like in this case is D and go back to the home menu, find numbers and select % click on it and there you will get your gain value in percentage.

We got 20% from our workings above.

That’s it!

That’s how you get to calculate your percentage gain of your investment on excel.

Here Are Common Excel Errors You Are Likely To Encounter in Calculating Your Percentage Gain and How To Fix Them

NUM! When you enter invalid numerical value you are warned with that.to avoid that enter numeric values.

#NAME? Typing wrong values in the formula will lead to this. The cell you highlight e.g. C2, B2 was used in the formula as opposed to S and P which represented the selling price and initial purchase price as in the case above.

#REF! These occur when you delete cells that have been referred to in the formula or you refer to invalid cells. Check the cells and refer to them as required.

###### means you have displayed too many values in a column. Try to expand the column.

Conclusion;

All you need in using investment calculator to work out your percentage gain/loss is your initial purchasing price and selling price of the investment.

Therefore as a core driver of your investment, it’s important that you get in touch with all documents that are relevant to your transactions including your purchase and sells contracts, receipts, statements etc.

The percentage gain or loss for your investment is gotten by subtracting the initial purchase price from the selling price multiplied by 100.

5 Responses

[…] track and account for your money.You are able to identify the operational costs for your business or investment and this enables you to comply with tax […]

[…] term investment goals can help your money outgrow […]

[…] identifying market demands, understanding competition, making calculated investments, and focusing on differentiation, entrepreneurs can pave their path to […]

[…] your money, you have to consider inflation since the rate of return on an investment is the percentage return you get from your investment minus the rate of […]

[…] allows you to put your money to work by earning returns through various investment options such as stocks, bonds, mutual funds, or real […]